MM Session 17 - Netflix in 2011

Introduction

In today’s session, we discussed the “Netflix: Pricing Decision 2011” case by David Robinson and Max Oltersdorf.

Let me take a moment to briefly summarise the case. On July 12, 2011, Netflix the online movie streaming service decided to split its DVD rental and Online streaming businesses. Until then, the two services were offered a bundle (this began sometime in 2007) at $9.99. From this point on, DVD rental shall cost consumers $7.99, while using both would cost consumers $15.98. Given that many consumers preferred to stream rather than rent out DVDs by this time (remember hit series like House of Cards and Breaking bad were out exclusively on Netflix streaming), there was widespread unhappiness with Netflix. In fact, over 800,000 subscribers (3.33% of total users) had dropped out of the service immediately after the price rise. There has been much written about particular incident especially considering that over 80% of the valuation of the company was wipe out immediately after it. The CEO of the company had also gone public to apologise for the manner in which the firm handled its communication. Found below is a video of the official apology:

Reed Hastings himself had remarked that he had “ slid into arrogance based upon past success”. While the manner in which communications were handled are a case study in themselves, how the incident unfolded has much to offer students interesting in learning the fine art of pricing. But before that, there is something that needs to be acknowledged.

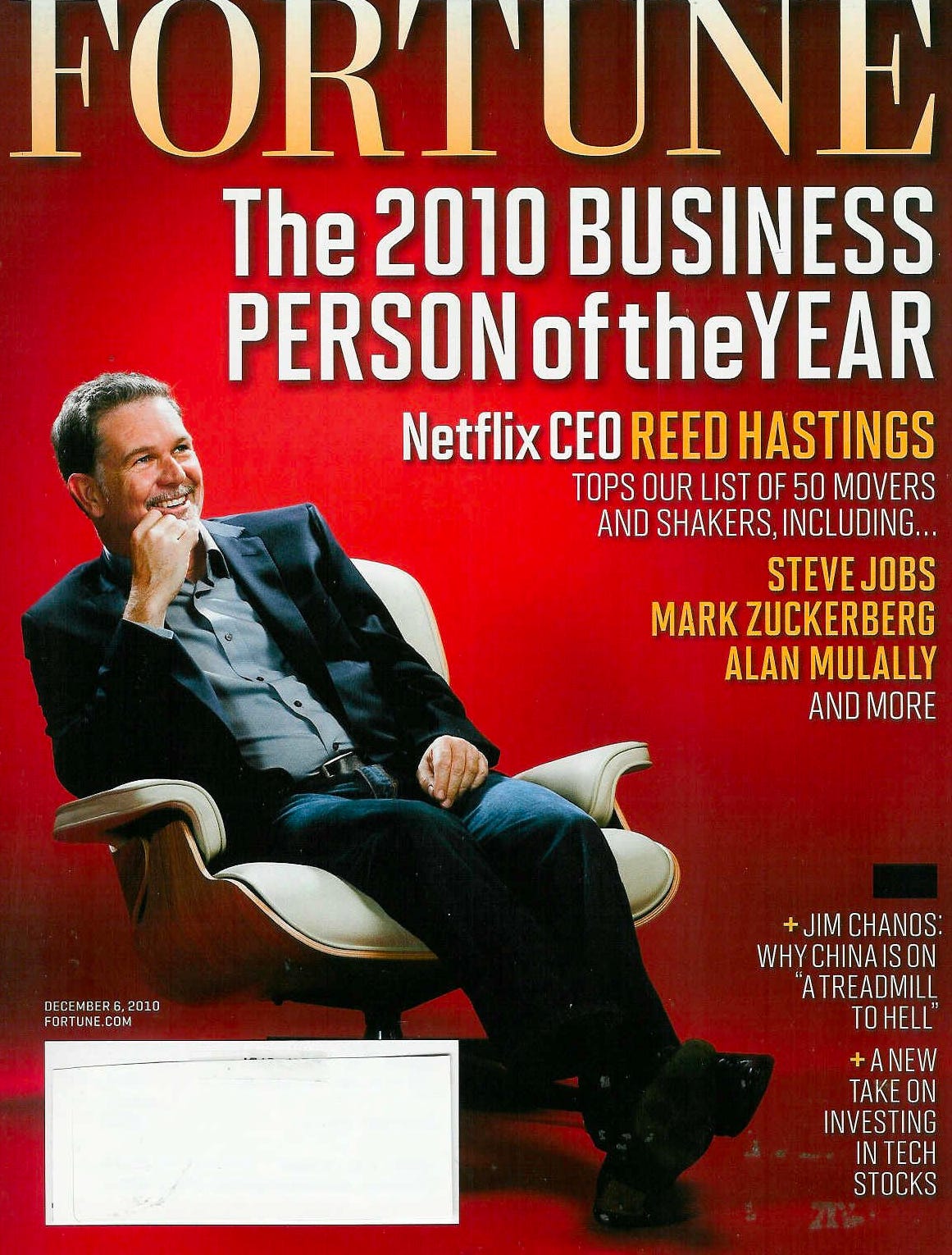

Hastings’ Hypermetropia

Any marketer has to agree that Reed Hastings was correct in as far as understanding that the age of DVD was over and it was necessary to look forward. Hastings, in his apology to Netflix’s customers had stated “for the past five years, my greatest fear at Netflix has been that we wouldn't make the leap from success in DVDs to success in streaming. Most companies that are great at something – like AOL dialup or Borders bookstores – do not become great at new things people want (streaming for us). So we moved quickly into streaming”. He was definitely correct in doing so. In fact, had it not been for this transition, Netflix may not have been alive today in the form we know. This is perhaps one of the most important take aways from the case - CEOs and CXOs are probably in the best possible situation to understand changing business dynamics, sometimes, even before consumers, and change does not necessarily have to be easy. It takes courage to do the right thing. (Interestingly, they reversed the planned split a few weeks later according to this NYT article). That’s perhaps why he was featured on Fortune magazine as the 2010 Business person of the year (Turns out, they wanted to have Alan Mulally from Ford on the cover, and they changed it last moment).

Pricing Lessons

Enough with the back story. There are several interesting ideas for students to learn from this case.

Pricing changes can be really hard to implement.

This is true, especially when there is an ongoing recession (this is 2011). Therefore it may be a good idea to offer customers a good alternative. Netflix actually did this by creating the $7.99 plan. If one does the math, they would quickly realise that this is a losing proposition. The idea was to hold on to a loss leader, just in case, as a suitable via-media.

However, it may be a good idea to not be completely tone deaf when implementing changes. Several people had also highlighted this. Famously, Howard Belk, the co-CEO of Sigel + Gale, a global branding agency headquartered in New York, had remarked “ The tone was wrong, the quantity of information was too little, and it came out of left field. The message didn't reflect any value to their customer base.” One has to agree with him on all counts.

Not all players in an industry follow the same pricing strategy

This may be hard for students to grasp, but not all competitors need to use similar logics to price their offerings. Think about it. Why would Disney, who sits on a world of high quality video content, Amazon, who had the means to bundle its online retail services together with streaming, HBO, who had a very loyal fan following thanks to their bold content strategy, Apple, who had a firm grip on the handheld multimedia devices market, decide to price in a manner similar to that of Netflix. Netflix was perhaps the only ‘pure play’ streaming service provider in the fray?

Much has been written about how these firms have used their strengths to gain a foothold into the online streaming market.

Consumers may also evaluate products and services as a basket

The case describes that most consumers typically subscribe to 2-3 streaming platforms. Furthermore, consumers may also allocate a certain proportion of their earnings towards themes such as entertainment or travel. Therefore, Netflix’s price rise may have actually had a hidden benefit - hurting competition (This may be pure guess work, but hear me out).

A few years before the events of the case, Blockbuster, Netflix’s fiercest competitor, had launched a multimillion dollar ad campaign that was intent on taking on Netflix. But after the campaign had ended, Netflix had also benefitted immensely. In fact, Hastings had send Blockbuster a thank you note for helping improve Netflix’s business. However, there were really no reported claims by competitors that they had gained 800,000 (or some portion of that) subscribers. It’s true that these services are not really perfect substitutes, but we may read into this a little if we make that assumption. For instance (I’m really stretching it here) it is possible that the price rise from Netflix constituted a significant shift in the basket allocations by consumers. Many consumers may have in fact decided to let go of other services to make space for Netflix’s service that they valued. Since I am unable to get subscription data for all players from 2011 -2012, I am not able to make this claim with more certainty. Perhaps some of you can look into this and get to the bottom of it.

Other resources

I also that it would be a good idea to point you to some more resources on the subject matter.

Do check out these articles, they offer very interesting perspectives on the 2011 pricing conundrum.

- Netflix's lost year: The inside story of the price-hike train wreck by Greg Sandoval

- Netflix Quietly Perfected Their Pricing. Here’s What You Can Learn by Kyle Poyar

- Here's a look back at one of Carl Icahn's gigantic mistakes by Kim Iskyan

There is also this excellent podcast series by David Brown called Business Wars. You can find it here. It’s also available on a wide variety of podcasting platforms. Incidentally, it was the same Netflix vs Blockbuster case that the podcast series featured when it launched. They also revisited the series later on in 2019 in their 18th season (link here).

Happy learning.

All the best for the upcoming presentations!