MM Session 16 - Economic Foundations of Pricing

Introduction

The issue of pricing lies at the very heart of marketing. In fact, it also happens to be one of the four Ps of marketing (Fun fact, the 4Ps was a term coined by Jerome McCarthy).

Much of our theoretical understanding of pricing comes find their roots in economics. While most economists who contributed to building this coherent theory on pricing argued aggressively that pricing could be approached in a scientific manner, they also tended to agree that there was an artistic element to it. This art, like most others, is not very easy to master. However, with some level of devotion, one you gain a working understanding of the broad strokes of the subject. As history has shown us, errors in pricing has spelt doom for many products and firms. An example close to home is that of Tata Nano. Thousands of pages have been written about how the failure to price correctly caused the mighty Tatas to fail in the Indian automobile markets. Before we begin our exploration into pricing, let’s begin by talking about a related idea - Money.

History of money

For a very long time in history, the factors of products (land, labour, capital (and more recently data)) were located close to those who consumed. For instance, a villager in Harappa may not have had to move too far to get his pots, wheat and clothes. This meant that individuals could agree to barter products and services. The barter system was not without problems. Scholars argue about 2 major issues with it. First, bartering required the mutual coincidence of wants. i.e. someone wanted what you had to trade. Second, the system gets really difficult to standardise when the number of products being traded grew. The lacunae in the system necessitated the creation of an improved system - one that involved standardised currencies.

Soon enough, kings and queens around the world issued coins with that bore their own images or those of gods. These coins were then replaced by paper notes that were backed by a reserve in gold. Not too long ago, the gold standard was disbanded and we marched into the era of fiat currency, and are briskly moving towards crypto currencies (For a brief overview of this change (barring the crypto part), please read this article and check out the History of money by Jack Weatherford).

Today, most scholars subscribe to Pierre Bordieu’s definition of Capital from his seminal work - the Forms of Capital. In the paper, he argues that “ Capital is accumulated labor (in its materialized form or its “incorporated,” embodied form) which, when appropriated on a private, i.e., exclusive, basis by agents or groups of agents, enables them to appropriate social energy in the form of reified or living labor”. In simpler terms, the philosopher argues that capital is the storehouse of labour. It can be traded for others’ labour, or the products of others’ labour. He also goes on to say that money is not the only form of capital, one’s standing on society too , he argues, can act as capital (he calls this social capital).

It is this idea of capital that is at the center of pricing. In other words, when we engage in a market transaction, we are in effect trading stored labour. It may be important for students to understand and appreciate this aspect about money.

The Economic foundations of pricing

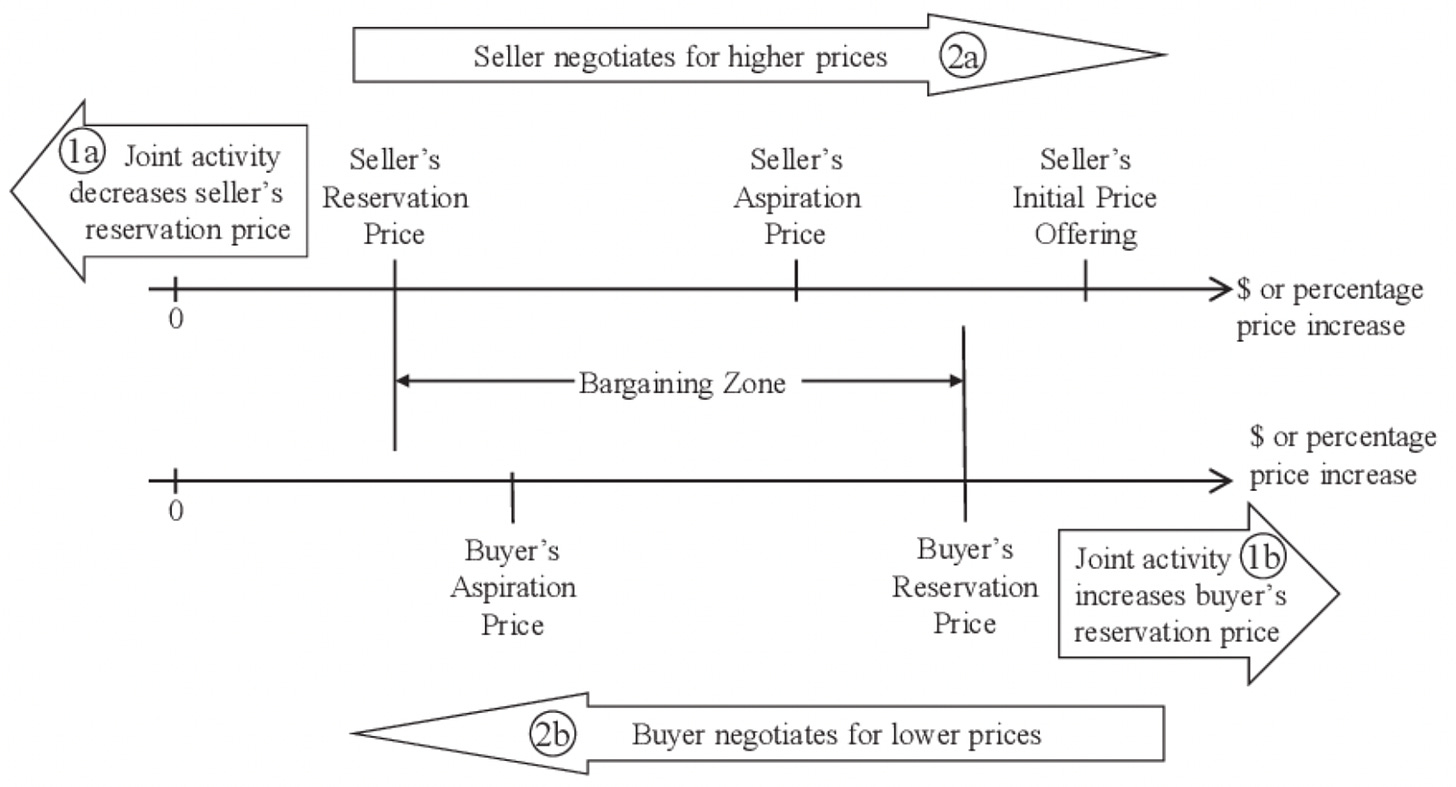

One of the key ideas upon which the theory of price is built stems from what we refer to as reservation prices. Both buyers and sellers have reservations prices. The buyers’ reservation price is the price above which a buyer will not make a purchase. A seller’s reservation price is the price below which a seller will not agree to sell. The diagram found below (Source: Dr. Dirk Moosmayer, Dr. Bjoern Schuppar, and Dr. F. Siems’s article from the Journal of Supply Chain Management) illustrate this clearly.

There are several strategies that marketers typically employ when trying to price products and services. While you will explore each of these strategies in depth during the pricing elective next year, in this session, we will primarily limit our attention to a brief introduction.

Price discrimination strategies- The set of all strategies that involve charging different consumers different prices.

- First degree price discrimination - A completely personalised pricing approach where marketers discover every buyer’s reservation price and price accordingly.

- Second degree price discrimination - This strategy involves marketers charging consumers different prices based on the quantity of product demanded. Think of this as volume discounts.

- Third degree price discrimination - This involves charging different segments of the population different prices. Think apple education discounts.

Periodic discounting

This strategy involves offering discounts to the products during certain periods. The issue with this approach is sometimes, customers learn and start waiting for the discounts to be available before they make the purchase. In order to counter this, marketers typically use the next approach.

Random discounting

This approach is similar to periodic discounting, except that the discounting is completely randomly assigned. This way, consumers cannot predict reliably when discounts are going to be in place.

Penetration pricing

Penetration pricing involves firms pricing their products very low at the time of introduction and then slowly upping the price. This is done to capture market share and encourage adoption/trial. A good example to think about here is Reliance Jio. The polar opposite of this is price skimming which you can think of as incremental periodic discounting.

Price signalling

Signalling is the idea that information can be credibly conveyed by one party to another due to certain behaviours. In biology, peacocks signal that they are suitable mates to peahens by having a large plumage. Interestingly, men and women from the middle ages expected their respective ‘spice’ to be fat? Why you ask? being fat was considered a signal of prosperity. i.e. it was not easy for someone to be fat/well built unless there was plenty to go around. In recent times, this logic has inverted. Price too has been routinely used by marketers to signal quality. Check out this Stanford article to learn more.

Bundling

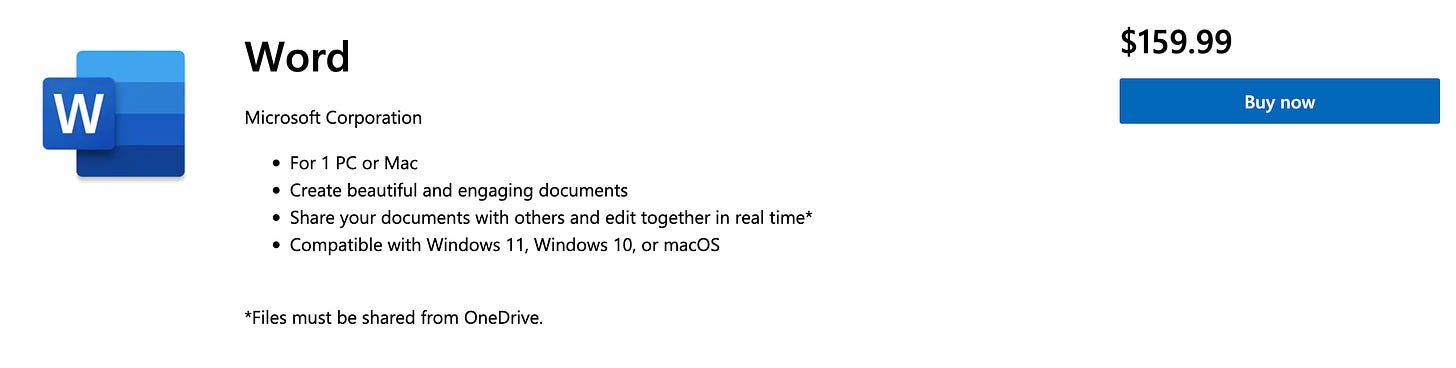

Bundling occurs when firms club separate products into one package and offer them together at a reduced price. Think of MS office. You could buy Word, Powerpoint, and Excel separately and pay about $160 for each (screenshot from today found below)

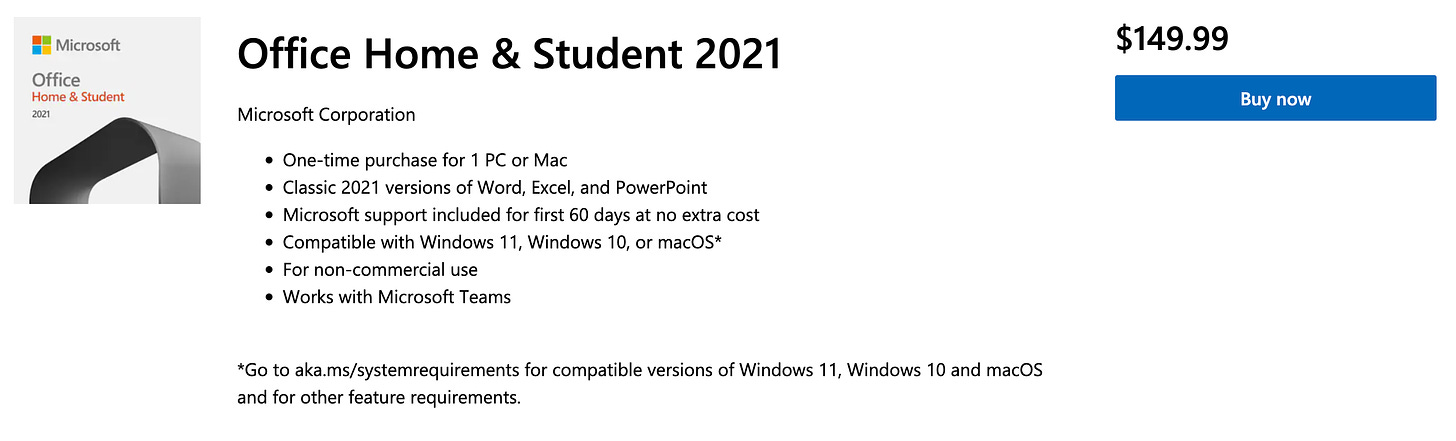

or, you could buy them all together in a bundle (surprisingly, for a lower price)

In addition to the afore mentioned pricing strategies, please also look into

There are many more strategies and tactics that marketers use to price products and services. However, the the purpose of our discussion, I feel a brief overview may be sufficient. However, I thought it best to point you to some interesting resources should you want to explore more. You may find the same below:

Additional resources

- Thomas Nagle’s book- My personal favourite

- Priceless: The Myth of Fair Value (and How to Take Advantage of It)

- The Psychology of Price: How to use price to increase demand, profit and customer satisfaction

Confessions of the Pricing Man: How Price Affects Everything

Closing remarks

Have a great fresher’s party today! Please read the case again for the next class. Hoping to have a great debate on how Netflix could have done a better job with the pricing conundrum they found themselves in in 2011.

Happy learning!