CB Session 15 - Prospect theory, biases, and misbehaving

Challenging the Homo-economicus assumption

Disclaimer

Apologies for not being able to send in the newsletter yesterday. I have been swamped with work and have not been able to find time to put pen to paper. But then here I am, typing away right now.

Introduction

For most of the course, we have been been working with some assumptions in the back of our minds. For instance, we have assumed that consumers are inherently rational creatures and there are frameworks and models that can helps us make sense of them. Such assumptions may not hold water in reality. More often than not, human beings are extraordinarily irrational. Some scholars have tried to argue that the irrationality that human beings exhibit, is somewhat predictable. Let me introduce some of the front runners in this debate to you: Daniel Kahneman, Amos Tversky, and Richard Thaler. Interestingly, Kahneman won the Nobel Prize for economics in 2002. Fifteen years later, Thaler won the Nobel (once again in economics). All of them played a critical role in integrating economics with psychology. While the scholars themselves may not be known to everyone, their contributions and the field they created stays with us almost on an everyday basis. Today, we refer to this as ‘behavioural economics’ and ‘Prospect Theory”. Behavioural finance is simply an offshoot of behavioural economics. What is not really mentioned a lot is that many marketing phenomena can actually be explained through their work.

Let’s try and understand what the theory is all about in brief.

Prospect Theory

prospect (noun)

/ˈprɒspɛkt/

#meaning: the possibility or likelihood of some future event occurring.

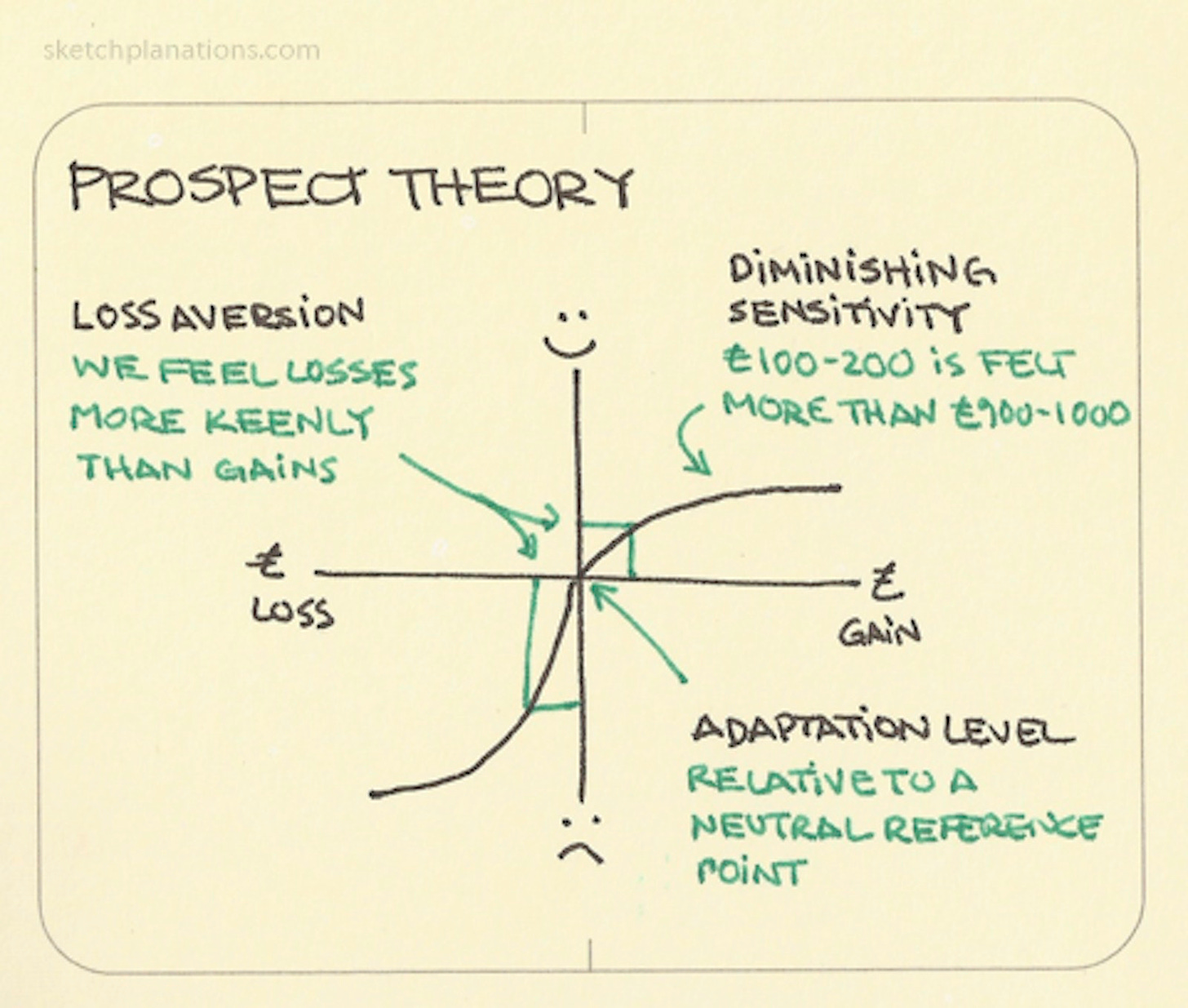

#example: "there was no prospect of a reconciliation"In simple words, prospect theory states that we, as individuals, we do not treat gains and losses (of the same magnitude) the same. We are likely to be averse to risk when we are faced with possible economic gains. However, when faced with a possibility of loss, we are relatively risk seeking.

Recall the series of hand-raise-experiments we conducted in class. When asked to choose between a 20% probability of getting Rs. 5000/- and a 100% probability of getting Rs. 1000/-, most of you choose to stick to the latter option. However, when we reversed the question and asked if you would like to lose Rs. 1000/- with absolute certainty or lose RS. 5000/- with a 20% probability, most of you wanted to take the risk and choose the latter option. Why should you that be the case? If there is anything you learnt in Business Math or Statistics class, it is the fact both these options have the exact same expected outcomes. Despite that, people seem to overwhelmingly make choices contrary to that.

The following figure from sketchplantation.com may help you gain some more clarity on the matter. On the x axis is the actual gain or loss that is made by the consumer. On the y axis is the perceived gain or loss that is felt by the consumer.

Let me try and illustrate this with a few examples for other contexts.

We just witnessed Cyrus Mistry die in a car crash. One of the reasons that is constantly cited for his death is him not wearing seat belts. Many governments are implementing legislation to compulsorily wear seat-belts, even in the back seat now. Now, if you are to develop a campaign to get people to wear seat belts, what would you rather choose?POLL

Which ad do you think is more likely to succeed?“Seat belts save over 20k lives"0%"5k+ die due to not wearing SB"100%3 VOTES · POLL CLOSED

Apologies for the cryptic slogans, there appears to be a character limit for this feature.

Ideally, you would would prefer to use the 5000 people’s death scenario since consumers don’t want to think of themselves to be one of those 5000 people. This is actually the single most important reason people but extended warranties and various theft and travel insurance products among others.

The opposite effect is also true.

Which of the two potential yogurt choices would you indulge in?POLL

Yogurt choices90% fat free75%10% fat25%4 VOTES · POLL CLOSED

I’m willing to bet that many would actually prefer the 90% fat free version even though both alternatives have exactly the same amount of fat. Why is that? The answer- prospect theory.

In consumer behaviour, we call this framing. There are, as expected, two types of framing - positive and negative. In the positive framing scenario, marketers emphasise the benefits of the purchasing the product. You want to showcase that these benefits are certain (and not probabilistic). Examples could include ‘best in class mileage’, ‘9 out of 10 doctors recommend this’, etc. Negative framing is what we do when we stress of the potential loss that could occur if not for the purchase of the product. Think about any insurance ad. I’m appending something below for your reference.

Other forms of biases

There are many other biases that consumers typically fall victim to. Here is a (not so comprehensive list) of such biases you can think about.

- In-group bias - The act of “favouring one’s own group over other groups” (Brewer, 1979)

- Self serving bias - Taking credit for positive events or outcomes, but blaming outside factors for negative events (Clapham and Schwenk, 1991)

- Dunning-Kruger Effect - The Bias whereby people with low ability at a task overestimate their own ability and people with high ability at a task underestimate their own ability (Kruger and Dunning, 1999)

- Confirmation Bias - the tendency to search for, interpret, favor, and recall information in a way that confirms or supports one's prior beliefs or values (Nickerson, 1998)

- Survivorship Bias - the “logical error of concentrating on the people or things that made it past some selection process and overlooking those that did not, typically because of their lack of visibility.”

- Halo effect - the "tendency in rating to be influenced by general impression or attitude when trying to judge separate traits."

If you would like to learn more about these topics, I recommend the following books to get started:

- Thinking, Fast and Slow by Daniel Kahneman himself

- Misbehaving: The Making of Behavioural Economics by Richard Thaler

- Consumer Psychology and Consumer Behavior: Behavioral Economics and Cognitive Biases simplified - Improve your critical thinking by Max Mittelstaedt

Happy learning.

References

Brewer, M. B. (1979). In-group bias in the minimal intergroup situation: A cognitive-motivational analysis. Psychological bulletin, 86(2), 307.

Clapham, S. E., & Schwenk, C. R. (1991). Self‐serving attributions, managerial cognition, and company performance. Strategic Management Journal, 12(3), 219-229.

Kruger, J., & Dunning, D. (1999). Unskilled and unaware of it: how difficulties in recognizing one's own incompetence lead to inflated self-assessments. Journal of personality and social psychology, 77(6), 1121.

Nickerson, R. S. (1998). Confirmation bias: A ubiquitous phenomenon in many guises. Review of general psychology, 2(2), 175-220.

Carpenter, J. N., & Lynch, A. W. (1999). Survivorship bias and attrition effects in measures of performance persistence. Journal of financial economics, 54(3), 337-374.

English, H. B. (1934). A student's dictionary of psychological terms.